Landlord jargon buster: A comprehensive guide for property owners and landlords in Salford, Swinton, Eccles, and Greater Manchester.

Becoming a landlord in Salford, Swinton, Eccles, or Greater Manchester can be a very promising and financially rewarding venture. However, navigating the intricate world of property lettings can be overwhelming, especially when bombarded with unfamiliar terminology.

To help you make informed decisions and confidently manage your rental property, we’ve created a comprehensive Landlord Jargon Buster.

Understanding the lettings landscape in Greater Manchester:

Whether you’re a seasoned landlord or considering letting your property for the first time, getting to grips with the terminology will empower you to feel confident and get the most out of your lettings projects. So if 2024 is the time to let your property or venture into the lettings market through investing in Buy-to-Let properties in Greater Manchester, you’ll find our guide a helpful start and a great reference point.

We’re pleased to share this guide to the most commonly used letting and landlord jargon:

A-Z Landlord Jargon Buster:

A – Assured Shorthold Tenancy (AST):

The most common type of tenancy agreement, offering both landlords and tenants flexibility with a minimum term of six months.

B – Break Clause:

A provision in a tenancy agreement allowing either the landlord or tenant to terminate the contract before the fixed term ends.

C – Credit Check:

A crucial vetting process to assess a potential tenant’s financial reliability and ability to pay the expected rent.

D – Deposit Protection Scheme:

A government-backed initiative ensuring tenants’ deposits are safeguarded throughout the tenancy.

E – Energy Performance Certificate (EPC):

A legally required document providing information about a property’s energy efficiency, helping tenants gauge potential utility costs.

F – Full Management Service:

A service offered by letting agents that encompasses all aspects of property management, from finding tenants to handling maintenance issues.

G – Gas Safety Certificate:

A legal requirement confirming that gas appliances and installations in a property are safe and regularly maintained.

H – HMO (House in Multiple Occupation):

A property rented by three or more unrelated individuals who share communal facilities, triggering additional regulations.

I – Inventory:

A detailed list documenting the condition and contents of a property at the beginning of a tenancy, reducing disputes over deposit deductions.

J – Joint and Several Liability:

A clause in a tenancy agreement making all tenants collectively and individually responsible for the rent and property care.

K – Key Release Fee :

A fee charged by some landlords or agents for releasing the keys or renewing the tenancy. This is not considered good practice.

L – Landlord Insurance:

Specialised insurance covering risks associated with renting a property, including damage and loss of rental income.

M – Maintenance Reserve:

A fund set aside by landlords to cover unforeseen repair costs, ensuring prompt property upkeep.

N – Notice Period:

The specified duration, typically two months, during which either the landlord or tenant can formally terminate the tenancy by providing notice.

O – Outstanding Rent:

Rent payments that have not been received by the due date, requiring prompt action to avoid escalating issues.

P – Property Management:

The overall administration and maintenance of a rental property, often handled by landlords or delegated to a letting agent.

Q – Qualifying Tenancy:

A tenancy that meets specific criteria, determining whether it falls under assured shorthold or other categories.

R – Referencing:

The process of checking a tenant’s background, including credit history, employment status, and rental references.

S – Section 21 Notice:

A legal notice used by landlords to regain possession of their property without providing a reason, typically after the fixed term of an AST.

T – Tenancy Agreement:

A legally binding contract outlining the terms and conditions of the rental arrangement between landlord and tenant.

U – Utilities:

Basic services such as gas, electricity, water, and internet provided to tenants, with responsibility clearly outlined in the tenancy agreement.

V – Void Period:

The duration when a property is unoccupied between tenancies, potentially impacting a landlord’s income.

W – Withholding Consent:

Refusing to grant permission for tenant requests, such as making alterations to the property.

X – eXit Strategy:

A plan outlining how a landlord intends to conclude their property investment, whether through sale or other means.

Y – Yield:

The return on investment expressed as a percentage, calculated by dividing the annual rental income by the property’s value.

Z – Zero Deposit Scheme:

An alternative to traditional deposits, allowing tenants to rent a property without an upfront deposit payment.

Maximum rental returns and peace of mind for landlords in Greater Manchester

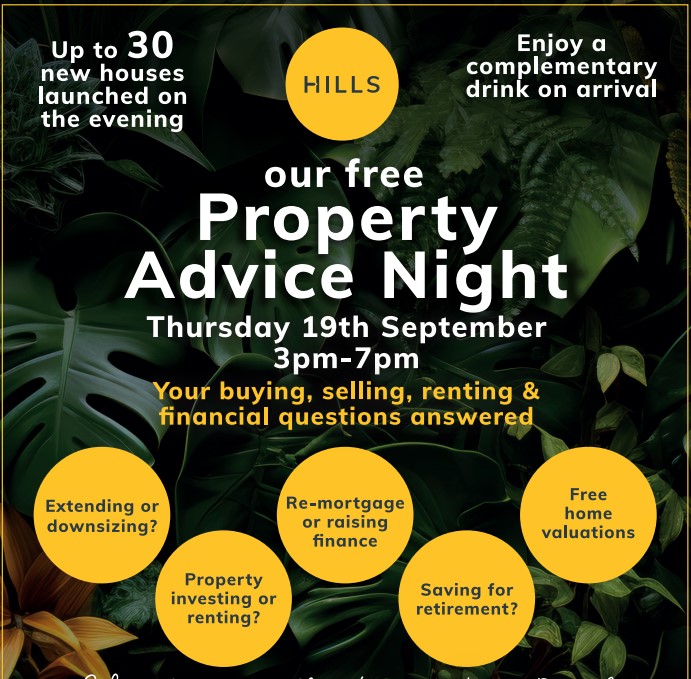

Armed with this landlord jargon buster, you’re better equipped let your property in Salford, Swinton, Eccles, and Greater Manchester with confidence. But fear not, you are never on your own. The experienced Lettings & Property Management team at Hills know the lettings market inside out and have full knowledge of not only the terminology, but all the legislation and compliance required for landlords to legally let property in the UK.

We make sure that our landlords, their properties and their tenants are protected and take care of the landlord compliance requirement on your behalf, so you can relax.

If you would like to discuss current opportunities available in the Buy-to-Let market in Greater Manchester and how to maximise financial returns as a landlord, please contact the Letting and Property Management Team at Hills in Greater Manchester on 0161 747 9379.

You may also be interested in...

Value my property today

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries

Buyers

Buyers

General

General

Buyers

Buyers