A positive start to 2024 for the Manchester property market.

Welcome to our latest property market update for Greater Manchester as we delve into the trends, challenges and opportunities shaping the property landscape in the first part of 2024.

At Hills we are committed to providing customers with valuable insights to guide your property decisions effectively. We know it’s a big deal to sell, buy, let or rent property.

We are keen to educate our customers and equip you with the necessary knowledge and resources to navigate the property market confidently. From ensuring buyers have a pre-approved mortgage in place, to facilitating a seamless sales process, our goal is to empower our clients to make informed decisions. Let’s start by looking at how the market has started in 2024 in Eccles, Salford, Swinton and Greater Manchester.

Market insights for 2024

Reflecting on the start of the year, January and February saw remarkable activity across the board. Across Salford we’ve sold over 100 homes since the start of the year, highlighting the robust demand in the area. Additionally, our offices registered a staggering 1600 new buyers, a testament to the enduring appeal of Manchester’s property market.

A firm indicator that the market is seeing more confidence is in the significant increase in property viewings, with January recording 828 viewings—a staggering 68% increase compared to the same period the previous year. This surge in interest underscores the growing confidence among buyers and sellers alike.

With mortgage rates becoming more favourable now compared to the last half of 2023, and projections for further interest rate reductions as the year goes on, we anticipate this increase in buyer activity to continue. It’s certainly very welcomed news.

Demand dynamics and property prices

Properties priced under £250,000 are experiencing high demand particularly among first-time buyers, leading to swift sales. Conversely, properties priced over £600,000 are sticking on the market a little longer as prospective buyers carefully evaluate their financial capabilities amidst concerns about mortgage affordability and the cost and feasibility of potential home improvements.

Navigating mortgage dynamics

In light of fluctuating interest rates, and up to now, the hardening of mortgage requirements and tightening of the number of deals available, potential buyers are meticulously assessing their financial readiness before committing to a property purchase. Buyers are taking a more considered approach, ensuring that their financial documentation is accurate and up to date so that they are in the best possible position to borrow when the right property comes along to buy. This is the right thing to do.

The impact of seasonality and future trends

As we transition into the spring season, we may see a shift in the market dynamics, with larger properties potentially gathering more attention. Moreover, the normalisation of market conditions in 2024 compared to the extremes we have witnessed during, and since the pandemic, brings a sense of reassurance to both buyers and sellers. This in turn, is fostering a conducive environment for property transactions.

Benefit from Hills’ in-house, independent financial advisors

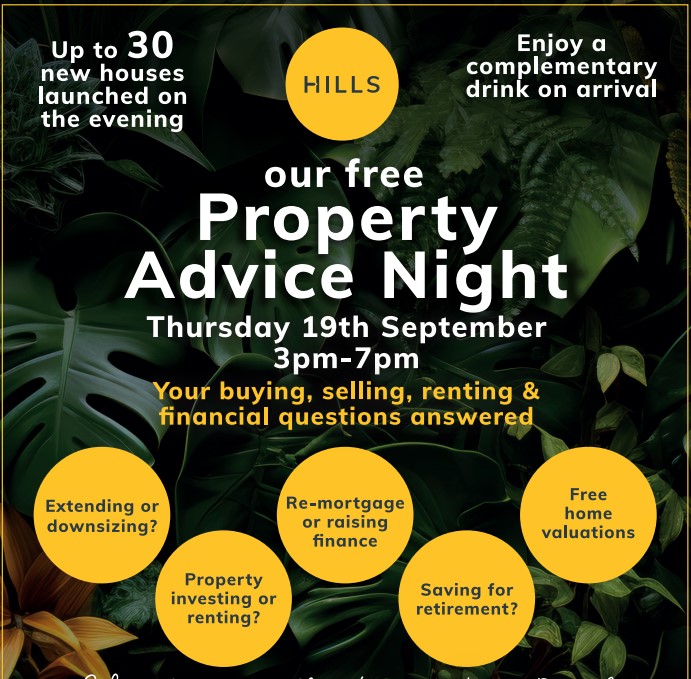

One key aspect of our service as a local estate agent in Eccles, Salford and Greater Manchester, is our provision of independent financial advisors (IFAs) who collaborate closely with our team of experienced agents. By having IFAs on board as part of our team, we ensure that our clients receive expert guidance on financial matters tailored to their individual circumstances. This partnership enables us to provide invaluable insights into market trends, mortgage options and financial planning strategies, empowering buyers to make well-informed decisions.

Additionally, our IFAs keep abreast of developments in the property market, allowing them to provide timely advice on available properties, financing options and potential investment opportunities. By leveraging the expertise of our IFAs, buyers benefit from a streamlined and efficient buying process, coupled with the peace of mind that comes from knowing they have a dedicated team supporting them every step of the way.

In the UK, using an IFA offers numerous benefits, including access to a wide range of mortgage products, personalised financial advice and assistance in navigating complex financial regulations. Moreover, IFAs prioritise the best interests of their clients, offering impartial recommendations tailored to individual needs and objectives – as opposed to being attached to one particular lender.

Anticipating the impact of the General Election

Looking ahead, the anticipated general election later this year may introduce a degree of uncertainty into the property market. Historically, general elections have been associated with temporary market slowdowns as buyers and sellers adopt a cautious approach until the political landscape stabilises. That said, post-election periods often witness renewed activity as confidence is restored, presenting opportune moments for property transactions.

Arguably, more people are taking the opportunity to act now, before the general election to sell or buy their next home, or invest in a property. Early signs are certainly for a positive spring ahead and everything points towards the first two quarters of 2024 being great times to move.

In summary

To recap, the Manchester property market in 2024 presents a positive landscape characterised by increased demand and market activity, boosted by favourable mortgage dynamics and a renewed confidence in the market.

For help with your specific property questions, don’t hesitate to reach out to our experienced team at Hills. Whether you’re a homeowner, landlord or house-hunter looking for your next property purchase, as the local go-to estate agent in Salford and neighbouring areas we are here to help you achieve your property goals in Greater Manchester.

Stay tuned for more updates and insights from Hills as we continue to navigate the Manchester property market together.

You may also be interested in...

Value my property today

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries

Buyers

Buyers

Buyers

Buyers

Buyers

Buyers