Hills Property Blog: September 2023

How to get the best mortgage deals when buying a property in Greater Manchester

The property market in Salford, Eccles, Swinton and Greater Manchester have over the years been dynamic and sought-after, and continue to be so. For that reason, buying your next home or investing in property in Manchester can be a sound move. However, recent developments in the UK mortgage market, including interest rate rises during 2023, have made finding the right mortgage deal more crucial than ever.

If you’re considering purchasing a property in Greater Manchester, you’ll want to ensure you secure the best mortgage deal available.

In this blog, we’ll guide you through essential steps to help you navigate the mortgage market and make a wise financial decision.

Comprehensive mortgage search

Begin your journey to home ownership by doing your mortgage research. You should explore various lenders, the banks and building societies, as each offers different terms and interest rates.

Online mortgage comparison tools can help streamline your search, providing you with an overview of available deals. But bear in mind, these tools do not give you an insight into the lender, their reputation and background information.

To make your research process a lot easier and more convenient, you can ask our Independent Financial Advisors to do all the searching for you. In one sweep, the Independent Financial Advisors working in partnership with Hills will be able to search the whole of the mortgage market and find you the best deal.

They know the lenders well and have an in-depth knowledge of the deals available. They will go through the pros and cons of each lender, including the specific terms and conditions of each deal, to find the lender and the deal that is best for you.

Evaluate your financial situation

Before diving into the mortgage market, take a close look at your financial situation.

- Calculate your budget, accounting for your current income, expenses, and any future financial changes.

- Determine how much you can comfortably afford to borrow and repay each month.

- Be realistic about your affordability; taking on a mortgage is a long-term commitment, and you want to ensure you can comfortably manage your repayments, even if interest rates fluctuate.

Consider fixed-rate mortgages

In a rising interest rate environment, fixed-rate mortgages can offer stability. With a fixed-rate mortgage, your interest rate remains unchanged for a predetermined period, usually two to five years. This shields you from the impact of further rate hikes during that time, allowing you to budget with confidence. Keep in mind that fixed-rate mortgages may initially have slightly higher interest rates than variable options, so weigh the pros and cons carefully.

Be mindful of affordability stress tests

Lenders in the UK now subject borrowers to affordability stress tests to ensure they can manage their mortgage payments even if rates rise. Be prepared for a rigorous assessment of your finances, including your ability to repay at higher interest rates. It’s essential to pass these tests to secure your desired mortgage. Work with your financial advisor to strengthen your application and increase your chances of approval.

Monitor the market

The UK mortgage market is dynamic and can change rapidly. Interest rates may fluctuate, and lenders may introduce new products or promotions. It’s crucial to stay informed and keep an eye on market developments. Your financial advisor can help you stay up-to-date and seize opportunities when favourable mortgage deals become available.

Seek independent financial advice

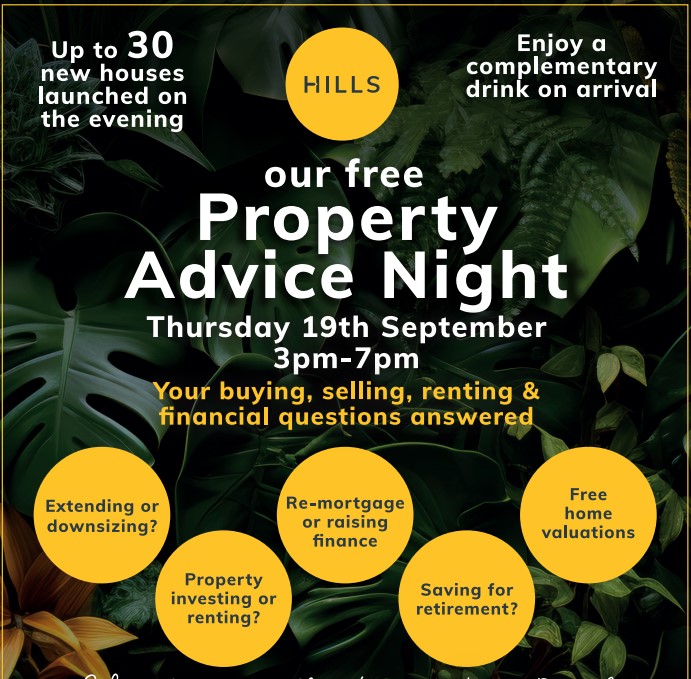

Given the complexities of the UK mortgage market and the recent interest rate hikes, it’s wise to seek independent financial advice. Many estate agents in Greater Manchester, like us, offer independent financial services. Our experts can provide invaluable insights into the best mortgage deals available to suit your unique circumstances.

They’ll help you navigate the market, ensuring you make informed decisions that align with your long-term financial goals. The trusted financial advisors have been working in partnership with Hills for many years and have helped hundreds of our customers reach their dream home and achieve their investment goals.

In summary…

Navigating the Greater Manchester property market in 2023 can seem daunting and requires careful planning, a thorough search, and professional guidance. But fear not, our Independent Financial Advisors will be by your side at every stage; do all the research so you don’t have to, and they will continue to support you with your financial needs even after your house purchase.

If you would like to discuss your financial position, learn about the current mortgage market and understand how much you are able to borrow towards your next property purchase, please get in touch.

Our advisors can meet with you in person or virtually at a time that suits you to start the process of buying your next home.

To get started, email sales@hills.agency and we’ll get right back to you.

You may also be interested in...

Value my property today

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries

Buyers

Buyers

Buyers

Buyers

Buyers

Buyers